Economics_RS Class 20

A BRIEF OVERVIEW OF THE PREVIOUS CLASS (05:00 PM)

BUDGET COMPONENTS (05:03 PM)

- Components of Budget

- The Budget primarily consists of 2 components such as receipts and expenditures.

- The receipts are further classified into Revenue receipts and Capital receipts and the expenditure is further classified into Revenue expenditure & capital expenditure.

- Revenue Receipts

- These receipts do not lead to a claim on the govt i.e. they neither create a liability nor decrease the assets of the government. Revenue receipts are further divided into Tax and Non-tax receipts.

- Tax receipts can be classified into direct taxes like Personal income tax, Corporate tax, etc, and Indirect taxes like Excise, Customs, GST, etc

- Non-Tax revenues of the central govt consist of interest received on account of loans given by the central govt, dividends and profits on investments made by the govt, fees, and other receipts for services rendered by the govt like social services, economic services, general services, Fiscal services.

- Capital Receipts

- All those receipts of the govt which create liability or reduce assets are termed as capital receipts.

- These receipts can be further divided into debt-creating capital receipts (borrowings) and non-debt-creating capital receipts (disinvestment, loans recovered).

- Revenue Expenditure

- It is the expenditure incurred for purposes other than the creation of physical or financial assets.

- These are expenditures incurred for the normal functioning of the govt like maintenance of law & order, interest payments, salaries & pensions paid, Grants given to state govt and other parties, subsidies given, Defense expenditures postal deficit, and noncapital expenditures on social services, general services, economic services etc

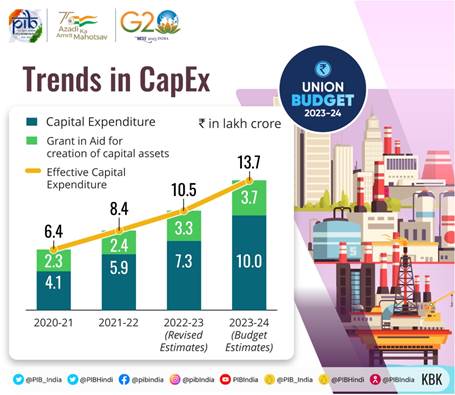

- Capital Expenditure

- These are expenditures of the govt which result in the creation of physical or financial assets or a reduction in financial liabilities.

- This includes expenditure on the acquisition of land, buildings, machinery, equipment, investment in shares, loans given by the central govt, and also loans repaid.

DIFFERENT TYPES OF DEFICIT (06:29 PM)

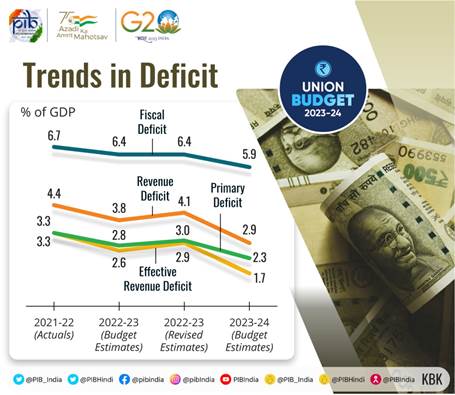

- Revenue Deficit (RD)

- It is the excess of government revenue expenditure (RE) over revenue receipts (RR)

- It indicates that government cannot meet its current expenditure from its current revenue.

- RD = RE - RR

- RD is seen as the most dangerous form of the deficit as it can lead to the depletion of existing assets and also an increase in govt liabilities.

- Budgetary Deficit (BD)

- It is an overall deficit and is currently it is not used for policymaking.

- It is the excess of the total expenditure over total receipts. BD includes both revenue and capital items mentioned in the receipts and expenditures. BD is financed either through borrowings, taxes, or printing money

- But govt has largely relied on borrowings for financing the budgetary deficits leading to an increase in govt debt

- Fiscal Deficit (FD)

- The difference between the govt total expenditure and total receipts excluding borrowings

- FD = Total expenditure - (Revenue Receipts + Non-Debt Creating Capital Receipts)

- Non Debt creating capital receipts are those which do not give rise to debt (loans recovered, disinvestment)

- FD also indicates the total borrowings of the govt

- FD= BD + Borrowings

- Now BD= 0 So, FD= Borrowings

- If there is a large share of RD in total FD it means that a large part of the borrowings are being used to finance the consumption requirements (not good for the country)

- Effective Revenue Deficit (ERD)

- It was introduced after 2012, after the changes in FRBM Act 2003

- ERD is nothing but a Revenue deficit excluding the grants given by the central government to states and UTs for capital purposes.

- Primary Deficit (PD) (06:57 PM)

- It is defined as FD minus the interest payments.

- PD= FD- Interest payements

- PD excludes the burden of previous debt and shows the net increase in government debts i.e. due in the current fiscal year.

- Budgetary estimates 2023-24- Primary deficit should be brought down to 2.3% of GDP

FISCAL RESPONSIBILITY AND BUDGET MANAGEMENT ACT 2003 (FRBM ACT 2003) (07:06 PM)

- Question- UPSC Mains 2019- Public expenditure management is a challenge to the government of India in the context of budget making during the post-liberalization period. Clarify it. (250 words/ 15 marks)

- Approach - Why was Public management after 1991 became a challenging task?

- Washington Consensus + Balancing Revenue, as well as capital expenditure (More FDI)+ Implementing reforms Second generation reforms

- Focus on Inclusive growth increased and the government took certain schemes such as - Mid-day meal/ TPDS/Antyodaya ann Yojana+

- India has to balance between Welfare and the targets given by the FRBM

- As per the 8th FYP, India's social sector expenditure increased, which was already less

- FRBM Act 2003 was enacted

- Government has to take care of states by increasing the centrally sponsored schemes and central sector schemes.

- The amount of money required for vertical devolution increased as per the recommendations of the Finance Commission.

- Fiscal consolidation [Reducing the FD]- Government cannot increase public expenditure indiscriminately

- 8th Five-year plan,1992 gave focus on Social expenditure + Infrastructure+ Inclusive growth,

- We also came up with a Gender Budgeting methodology that focused on the welfare of vulnerable groups about FRBM and gave a clear target to reduce the FD and RD.

- Second-generation reforms- Focus on Capital expenditure

- Microeconomic indicator under the track [FD], Clear targets for FD and RD

- Keep the Fiscal deficit under the track

- Government should not borrow from RBI indiscriminately

- States cannot spend as much as they like, states were also brought under the ambit of FRBM in 2012.

- FRBM Act 2003 (07:30 PM)

- FRBM Act is a law enacted by the government in 2003 to ensure Fiscal discipline by setting targets including the reduction of FD and elimination of Revenue Deficit (RD)In India, borrowing levels were very high during the 1990s and 2000s and the Indian economy was struggling due to high FD, high RD, and high debt/GDP ratio.

- By 2003, continuous government borrowings started pushing the government into a debt trap and the government started making interest payments which adversely affected its spending on infrastructure.

- And therefore a Bill was passed by the Indian parliament in 2003 which laid the foundation for Fiscal Responsibility and Budget Management.

- FRBM Act had to focus on Fiscal Discipline, Macroeconomic stability, effective management of expenditure, handling debt burden, better coordination between Fiscal policy and monetary policy, and also to bring transparency in the Fiscal operations of the government.

- Initial targets of FRBM till 2008-09

- Revenue deficit target- RD should be eliminated by March 31st, 2009. The minimum annual reduction target was 0.5% of the GDP.

- Fiscal deficit target- FD should be reduced to 3% of GDP by March 31st, 2009, the minimum annual reduction target was 0.3% of GDP.

- RBI's purchase of government bonds has to be ceased from 1st April 2006. This indicates that government can not borrow directly from RBI.

- Additional liabilities-It included external debt (* External debt has to be reduced to 9% of GDP by 2004-05).

- Due to the global financial crisis, the government resorted to Fiscal stimulus, and therefore FRBM targets were temporarily postponed.

AMENDMENTS IN FRBM ACT (07:41 PM)

- In 2012 and 2015 notable amendments were made including a new concept called Effective Revenue Deficit (ERD)

- The requirement of a Medium-term expenditure framework statement was also added through amendment in FRBM Act

- Documents required as per the requirement of the FRBM Act

- Medium Term Fiscal policy statement- It sets out a 3-year rolling target for 4 specific fiscal indicators in relation to GDP

- 1) Revenue deficit (RD)

- 2) Fiscal deficit (FD)

- 3) Tax/GDP ratio.

- 4) Total outstanding debt.

- N K Singh committee recommendations

- Developed countries have a higher Debt/ GDP ratio.

- How to increase GDP?- Fiscal and Monetary policy. When monetary policy is not able to increase the GDP then Fiscal stimulus can be given.

- The escape clause was clearly mentioned, i.e. circumstances under which these targets can be skipped.

- Macroeconomic Framework statement- Assessment of growth prospects of the economy (GDP growth rate) along with the fiscal balance of central government and the external sector balance of the economy.

- Fiscal policy strategy statement- it outlines the strategic priorities of the government concerning taxation, expenditure, lending, investments, administered pricing, and borrowings. The statement explains how current policies are in conformity with sound fiscal management principles.

The topic for the next class:- FRBM Amendments and Financial market.